Las Vegas-based cannabis distributors are observing distinct shifts in consumer behavior that paint a broader picture of a maturing, tourism-driven market. While traditional categories like flower remain strong, signs are clear: consumers now demand convenience, potency, experiences, and value-added products that reflect a sophisticated market profile.

1. Resurgence of Flower with Premium Positioning

Flower sales in Nevada, including Las Vegas, are showing signs of recovery. In May 2025, Nevada’s average price per gram was $16.03—a 4.2% increase from the previous year—while eighth-ounce packs sold annually around $23.24. According to Headset data, total flower sales reached $21.54 million, marked by modest month-over-month growth and new quality-seeking consumer segments. This indicates a pivot from budget shopping to premium, artisanal offerings—a clearer signal distributors report from in-store feedback.

2. Edibles & Vapor Pens: Demand for Discreet and Portable Options

Edibles and vapor pens are emerging as top growth categories. May 2025 saw edibles average $16.28 per 10 mg dose, with vapor-pen sales at $13.72 million for the month. Analysts attribute this to tourists and working professionals favoring discreet, social-friendly consumption. UNLV’s Cannabis Policy Institute underscores how tourism reshapes product portfolios—demanding convenience and discretion. Distributors confirm the trend: sleek, single-dose edibles and taste-focused vape pens now outsell traditional pre-rolls among newcomers.

3. Pre-rolls Dominate Consumption Habits

Pre-rolls remain a go-to for many consumers. National insights show they are “one of the easiest method[s] of consumption,” with quality innovations driving repeat purchases. Local Las Vegas distributors say infused, terpene-rich pre-rolls are flying off shelves—a reflection of both their competitive pricing and appeal to casual users and party crowds.

4. Concentrates and Capsules: Niche but Loyal

Concentrates remain smaller in sales volume: around $2.27 million in Nevada for May. Yet they attract a fiercely loyal core of users seeking high potency. Capsules and tinctures, while making up under $170k monthly, serve medical and wellness consumers—a consistent albeit niche base. Distributors confirm these segments stabilize sales even when recreational demand dips.

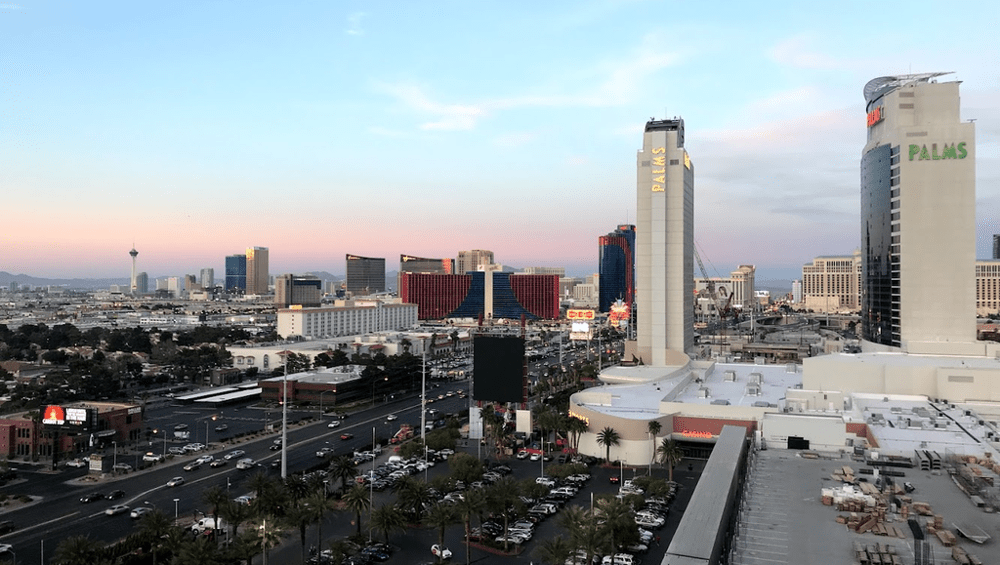

5. Cannabis Tourism and Regulatory Shifts

Las Vegas’s identity as a tourist mecca deeply influences consumer products. Distributors note tourists prefer packaged, regulated, consumption-site friendly options. Though Vegas licenses cannabis lounges (e.g., Planet 13’s Dazed), early venues like Smoke & Mirrors faced financial hurdles and under-utilization. Still, demand for hotel-friendly products (edibles, vapes) grows. The Lexi boutique hotel—Vegas’s first to allow in-room consumption—underwent renovations to accommodate cannabis-friendly stays.

6. Market Stabilization Amid Saturation

Overall, the Nevada cannabis market is contracting—sales are down about 13–15% year-over-year. Saturation among dispensaries and reduced tourist novelty are contributing factors. In response, distributors emphasize product diversification—differentiating through taste, dosing, packaging, and branded experiences to capture market share in a tighter ecosystem.

What It All Signals

Las Vegas distributors are navigating a transitional market: one that’s moving beyond high-volume recreational sales toward premium, on-the-go formats tailored to a discerning tourist and local crowd. Convenience, packaging sophistication, taste experiences, and regulation alignment are now the bedrock of product strategy. Distributors who anticipate these consumer preferences—and adapt offerings accordingly—are poised to thrive amid tightening competition. Meanwhile, niche categories like concentrates and capsules provide stability with loyal user bases.